Passive returns leveraging a diversified pool of AI-trading bots

BotsAutoTrading.AI Pooled Account Overview

March 2025

Executive Summary

Empower Individuals, Companies, and Funds to increase investment returns via proven, 100% passive AI-trained trading bots

Executive Summary

Empower Individuals, Companies, and Funds to increase investment returns via proven, 100% passive AI-trained trading bots

The heavy lifting is done on your behalf

AI-trained trading bots do the work for you…no sick days, no nights off

No more staring at charts and watching news cycles like a hawk

Easily diversify portion of overall investment portfolio

No sacrifice of direct access to your $$ (Bats.AI has ZERO access to your brokerage account)

Pooled account model enables 100% passive returns which are posted daily

Minimize account risk via diversified bots portfolio with low correlation

Benefit from monthly % returns that can rival market annual % returns

Ongoing performance tracking with back office updates to bots

Benefit from Bats.AI R&D testing of new & upcoming bots as opposed to incurring the cost and time burden of doing so directly

Trust – our own $$ is in the pooled account

Trust – our own $$ is in the pooled account

Quick introduction and background

Who is behind BotsAutoTrading.AI and why?

The Opportunity for Members

Take advantage of pre-vetted AI-trading bots to increase investment portfolio monthly returns while minimizing per bot entry cost and risking “lessons learned the hard way”

1

EVERY trading bot (‘Expert Advisor’) is taken through its paces and personally tested for performance, unique / low-correlated trading methodology, and risk vs return over varying market dynamics including black-swan events

2

While an increasing number of trained bots are becoming available, not all are ready for prime-time, many are overly hyped with shady money-back guarantees, and few live up to the expectations set via social media marketing

3

Pooling multiple bots that have low correlation is key to adapting across varying market conditions, macro-influences, outlier news events, etc…

4

While historical performance can not be promised as future performance, the bots we select must prove themselves through election cycles, black swan news events, seasonality, etc.

How to get started

There are necessary action items each member will need to complete in order to get started

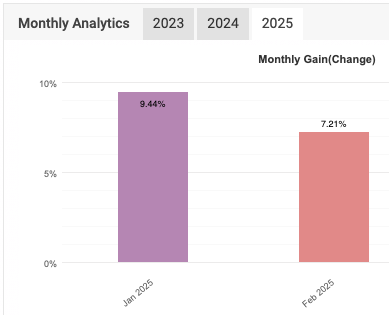

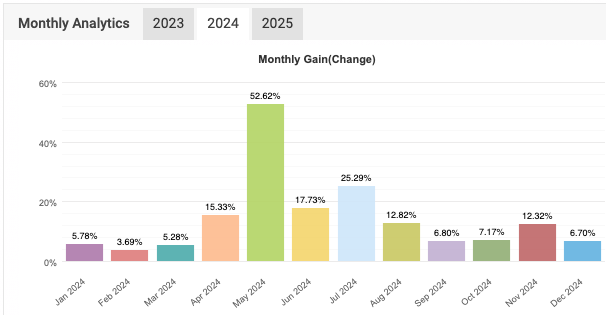

So what does the historical performance look like?

Snapshot of 2024 and 2025 YTD monthly performance is below

tracked via fxbook.com

2024 had a core bot / EA update in mid-Nov 2024

Frequently Asked Questions

You can absolutely do this on your own. In fact, that is how we started years ago. Although it was our personal experiences (and many others we’ve collaborated with over the years) that drove us to create this program. Key challenges, learnings, and manual intervention required actions we faced included…

High cost of entry per bot, ranging from $10k - $50k upfront license fee.

On top of the upfront license fees, a high minimum trading balance per bot was needed which ranged from $10k - $50k per bot.

Technically setting up each bot across every trading pair, which can range from 1 - 20+ depending on the bot.

Establishing at least one virtual private server (VPS) for ‘always on’ trading.

Testing different bots for optimal risk / reward performance, differing methodologies, and varying ongoing optimization roadmaps.

Manually adjusting trade sizes per trading pair per bot to benefit from compounding.

Manually intervening to risk-manage during unforeseen black-swan events (eg. Russia invading Ukraine, unexpected tariffs, random + aggressive Trump tweets, etc) which varied based on how the various bots were developed, trained, back-tested, and trading methodology(ies) deployed.

The above examples taught us the value of a pooled-account managed service (‘PAMM’) offering, hence the “birth” of BotsAutoTrading.AI.

If you would prefer to license these bots directly as opposed to participating in the pooled account, we are happy to refer & introduce you directly to those we trust and support.

x is a known, trusted, and regulated brokerage firm. The current bots leveraged by BAT.AI for PAMM were developed based on a minimum 1:200 margin ratio, which US brokers do not support.

As a financial services regulated broker, Ox Securities will need each Individual and / or Corporate account to verify identity, source of funds, etc with supporting documentation.

No. Your brokerage account is your account. Once set up, we have a tutorial doc to walk you through how to subscribe to the BAT.AI Master account. You determine how much of the available balance to be part of master account trading, when to add more, when to cash out profits, etc. Punchline – BAT.AI has no access to member accounts.

Our roadmap is aimed at enhancing member experiences and performance. We are currently testing a handful of new bots and may make portfolio modifications down the road based on results of current + future testing. In addition, we are exploring technical options which would accommodate trading accounts at firms other than Ox Securities to provide more optionality to members globally.

We are not tax advisors and everyone’s situation is different. We suggest each member discusses with their chosen tax professional and manages any tax related filings as you deem appropriate.

Historical performance does not guarantee future performance.

Do not allocate more money than you are willing to risk.

Experience shows this should be a portion of overall investment strategy and not the sole strategy.

BotsAutoTrading.AI is not a financial institution, financial advisor, consultant, or money management firm. We are providing a technology service which allows individuals and entities to leverage proven automated trading bots at their own risk.